Should You Add Buy Now, Pay Later Options to Your E-commerce Site?

There have never been as many ways to pay online as there are today. Nor has it ever been more important to make sure you offer your consumers their preferred option.

For some, that might be a long-trusted Visa or Mastercard. Others may prefer Apple Pay, PayPal, or another digital wallet. And, increasingly, consumers are choosing to use buy now, pay later solutions when they checkout.

But what is this payment solution? And is it time you added buy now, pay later to your website? Read on to get my views on the topic.

What is Buy now, Pay Later?

The name says it all. “Buy now, pay later” literally lets consumers buy a product and have it delivered while delaying payment until a later date.

This option is very similar to the old-school layaway method, in which stores let consumers reserve an item while paying it off in installments. Once all payments were made, they’d then be able to take the item home.

Buy now, pay later offers an even more consumer-friendly alternative to layaways. There’s no need to wait to access the item until it’s paid off in full—consumers only have to wait for their items for as long as they take to reach their doorsteps.

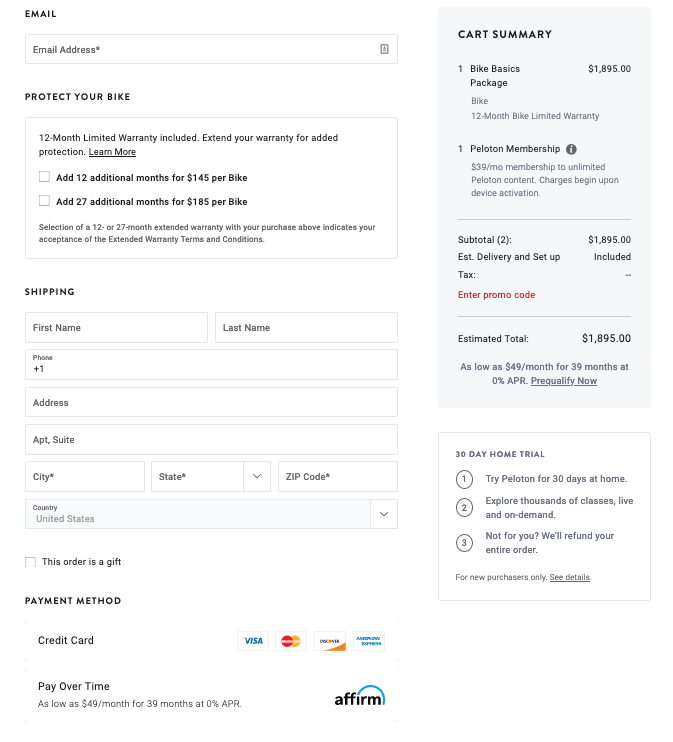

You’ve probably seen buy now, pay later payment options at checkouts in many places you shop. Mattress company Leesa partners with Affirm. Anthropologie partners with Klarna. Sezzle partners with Bodega.

Unlike layaways, consumers don’t necessarily use buy now, pay later to fund expensive purchases. They use the payment method to buy all kinds of things, from everyday needs like clothing and homeware to big-ticket items like fitness equipment.

While there are several options for buying now and paying later, they all broadly offer the same thing. The consumer gets to make repayments over several installments (typically between two and four) or in full within 14 to 30 days. Failing to pay will usually result in a fee, but not always.

One of the reasons buy now, pay later solutions are proving so popular is because they offer consumers an easier way to access credit. Unlike credit cards, which require users to hand over a lot of information and pass a rigorous credit check, buy now, pay later providers only ask for a consumer’s name, email address, date of birth, and billing address.

The solutions also mirror the purchasing habits of young consumers who are more likely to buy a selection of items, try them out at home, and then return the ones they don’t want. Returns are often more manageable and less stressful using a buy now, pay later solution since consumers don’t pay for the products in the first place.

6 Reasons to Add Buy Now, Pay Later Options to Your E-Commerce Site

It’s not just consumers who like buy now, pay later solutions. There’s a lot to like about them from a store owner’s point of view, too.

Here are six benefits to buy now, pay later.

Potential Sales Increases With Buy Now, Pay Later

When you allow consumers to spread out payments, they may be more likely to make a purchase. Consumers don’t even have to have the money in their account to buy your products.

They just have to be confident they can pay for them in the next few weeks. This is particularly handy for capturing consumers with paydays on the horizon.

The increase in conversions can be particularly dramatic if your items are higher priced, as consumers may be more willing to buy something pricey they otherwise wouldn’t when they can split the payment into manageable chunks.

Buy Now, Pay Later May Entice New Customers

More and more consumers are choosing this payment option. Even if they have the cash in their banks, there is little downside to spreading the payments out when they aren’t charged interest.

That means some consumers might actively look for stores that offer their favorite buy now, pay later options. Recognizing this, many buy now, pay later providers offer lists of where the service can be used. Some, like Klarna, even have apps allowing consumers to shop online directly through them.

Buy Now, Pay Later Could Build Trust

It used to be almost impossible to get a trial period for many consumer products, but buy now, pay later often makes this possible. By purchasing via a buy now, pay later solution, consumers can test out your product without committing to the purchase.

If they like it, they can pay as usual. If not, they can return it without having to worry about getting a full refund since they haven’t spent much, if anything, yet.

A small increase in free returns may cost you more in the short-term, but the long-term benefits of increased consumer loyalty can be substantial.

Customers may see you have enough confidence in your products to risk the possibility of returns and trust them enough to make good judgment calls for themselves, free of the questioning they may get in stores.

You May Decrease Cart Abandonment With Buy Now, Pay Later

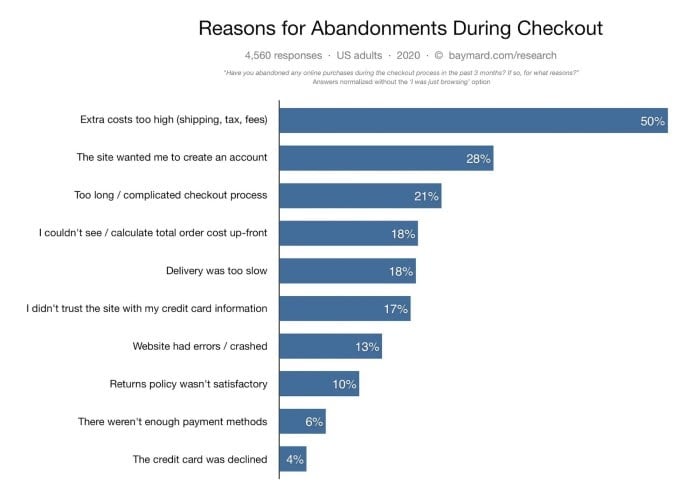

Around 6% of cart abandonments are caused by a lack of payment options, according to the Baymard Institute. If you increase payment options by including a buy now, pay later solution, you may see a decrease in your abandonment rates.

That’s not all, though.

Buy now, pay later can also make your checkout process much smoother. Consumers don’t have to enter card details or a billing address; they only need to log in with their Klarna or Affirm account. This fact is important because 28% abandoned their carts because they didn’t want to create an account, and 17% didn’t trust the sites with their information.

Your Competitors May Already Use Buy Now, Pay Later

If your competitors haven’t already integrated at least one buy now, pay later solution into their checkout, the chances are high they will do it soon. Research shows one-third of US-based e-commerce stores plan to integrate a purchase finance option over the next one to two years.

If you fail to keep up with consumer demands, you’ll inevitably lose customers to competitors that do keep pace.

Buy Now, Pay Later May Give Consumers a Better Credit Solution

The fact of the matter is buy now, pay later is a much more affordable finance solution than credit cards for many consumers. Not only that, they are often a much safer form of debt than credit cards or payday loans.

The former can have double-digit interest rates, while the latter can trap you into a spiral of debt. And if your customers need those to pay for things, they may hesitate to make purchases at all or end up in a financial situation where they can’t become a repeat customer.

You may worry about selling to customers who can’t afford the products up front, but don’t worry: like credit cards, buy now, pay later companies pay you when the transaction is made, and it’s on them to pursue non-paying customers.

3 Reasons Not to Add Buy Now, Pay Later to Your E-commerce Site

Buy now, pay later tools aren’t perfect for everyone. As a consumer finance solution, there are some issues you need to consider.

Buy Now, Pay Later Services Often Require Higher Fees

There’s a cost for the increased conversion rates and new customers that buy now, pay later can bring. They come in the form of higher fees. Klarna, for instance, charges a $0.30 fee and a variable charge of up to 5.99%. That’s significantly higher than almost all Visa and Mastercard payment gateways.

It’s not just the higher fees you need to worry about. There’s also the opportunity cost of listing another payment solution. Every time consumers use a buy now, pay later option, they are choosing not to use another payment option with lower fees.

Buy Now, Pay Later Could Encourage Consumer Debt

While buy now, pay later solutions are marketed as consumer-friendly finance products, some critics believe they are just another way to trick consumers into taking on more debt than they need.

This is true whether you sell t-shirts at $10 a pop or mattresses for $1,000. Buy now, pay later encourages consumers to take out credit agreements with third-parties even if they can already afford to pay for the product in cash.

You Could Risk Your Reputation if Buy Now, Pay Later Problems Arise

Owing to the issues above, buy now, pay later solutions have received a lot of negative media coverage. There’s every chance these solutions may be looked on favorably in the future given the value they provide for some consumers—but only time will tell.

If negative media coverage of these solutions grows, and public opinion turns against these options, brands that facilitated these payments may become targets.

However, this coverage could disappear or improve as people become more used to these products, so it’s something to consider but not necessarily something to panic over.

Best Buy Now, Pay Later Tools

Competition in the buy now, pay later space is fierce and growing. That means consumers have more options. You’ll probably want to consider having more than one buy now, pay later option to keep consumers happy.

Here are some of the leading players you should consider integrating into your checkout.

Klarna

Klarna is a Swedish bank and one of the most prominent players in the buy now, pay later market, partnering with thousands of businesses in almost 20 countries. The platform offers users two ways to make repayments: “slice it” and “pay later.”

With slice it, consumers pay for purchases in four installments over six weeks. With pay later, consumers receive a bill for the full amount after 30 days. The payments are interest-free for consumers who qualify. Brands using Klarna include Uniqlo, H&M, and Anthropologie.

Affirm

Affirm is designed to help consumers finance purchases of all sizes. It supports small, everyday purchases like the rest of the solutions in this list, with interest-free payments split over weeks or months.

It also helps consumers make more significant purchases or needs like car repairs with interest-bearing loans spread over six to 18 months. How long consumers spread out the payments is up to them.

Affirm also doesn’t charge any fees, including late and repayments fees. There’s no fee to open or close an account, either. Brands using Affirm include Peloton, Walmart, and adidas.

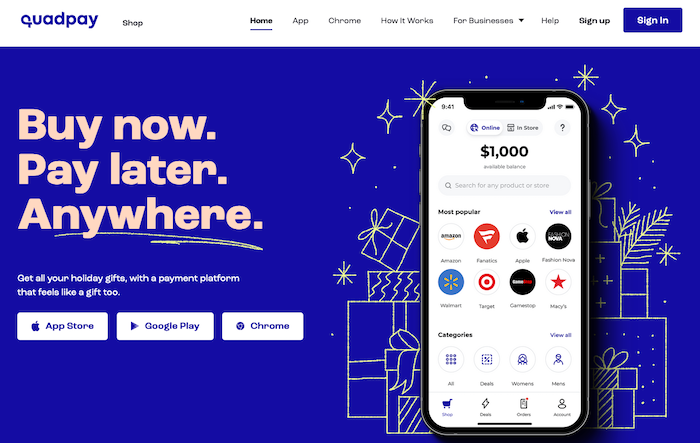

Quadpay

Quadpay lets consumers split purchases into four installments paid over six weeks when they shop online or in-store. Approval is instant and performed using soft credit checks.

There’s no need for store owners to install Quadpay at their checkouts. The payment tool is available anywhere Visa is accepted because the company provides users with their own Quadpay Visa card numbers.

All your customers need to do is choose the retailer and enter the purchase amount—Quadpay takes care of everything else.

Sezzle

Sezzle lets consumers split purchases into four interest-free payments due over six weeks. There are no fees if consumers pay on time, and there’s no impact on their credit ratings.

Sezzle partners with over 24,000 stores, including Brandless, YoungLA, and GHOST, and integrates with all leading e-commerce platforms.

Afterpay

Afterpay lets consumers make interest-free purchases and repay the amount with four equal payments due every two weeks. If consumers miss a payment, Afterpay charges them $10. A further $7 will be charged if they fail to make payment within a week.

Afterpay differs from some lenders on this list by approving users for every purchase rather than approving an account. The company has stated its algorithm has been programmed to favor users who have previously used the service and paid on time. Participating brands include Jimmy Choo, lululemon, and UGG.

Conclusion

It’s essential to provide as many payment options as possible and give your consumers their preferred choices. Integrating a buy now, pay later solution can result in more sales, decrease cart abandonment rates, and build trust.

You also need to consider drawbacks, like the higher rates that come with buy now, pay later options.

Will you be adding a buy now, pay later solution to your site, and if so, which one?

The post Should You Add Buy Now, Pay Later Options to Your E-commerce Site? appeared first on Neil Patel.

from Neil Patel https://ift.tt/34MqTzx

No comments